Lopez Corporation incurred the following costs, and this in-depth analysis delves into the various cost categories, their impact on financial performance, allocation methods, control measures, and financial reporting implications. This comprehensive examination provides valuable insights into the intricacies of cost management and its significance for corporate decision-making.

The subsequent paragraphs explore the nature and characteristics of each cost incurred, examining their impact on the company’s financial performance and identifying areas for cost optimization. The analysis delves into the methods used to allocate costs to different departments or business units, highlighting the advantages and disadvantages of each approach.

Cost Categories

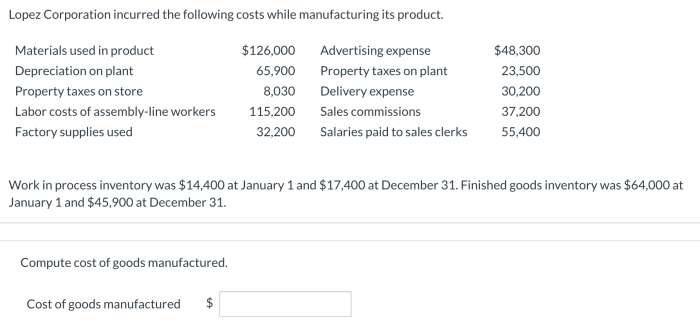

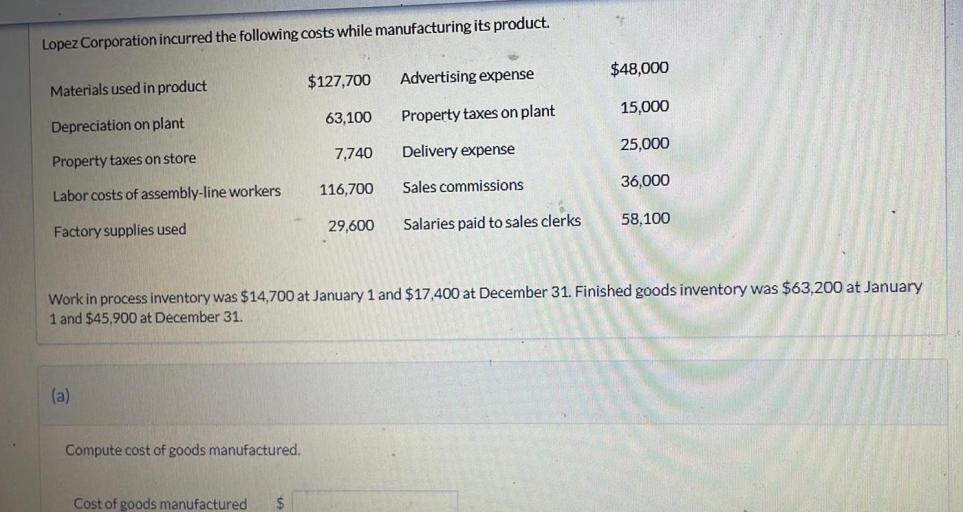

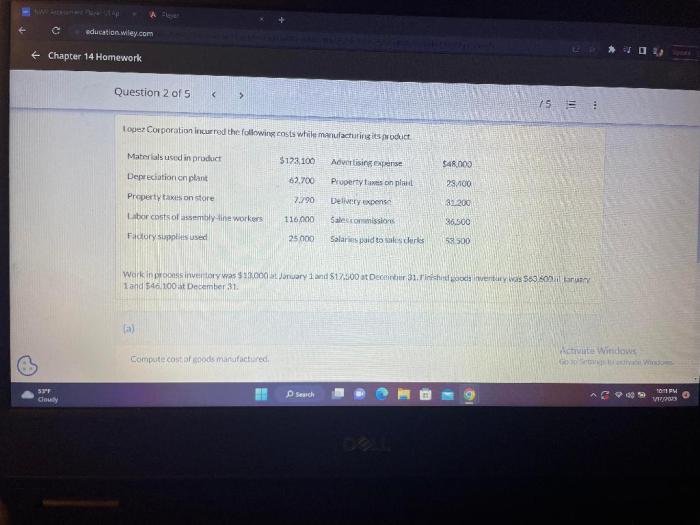

Lopez Corporation incurs various types of costs during its operations, which can be classified into the following categories:

Direct Costs

- Raw materials: Costs of materials directly used in the production of goods or services.

- Direct labor: Wages and salaries paid to employees directly involved in the production process.

Indirect Costs

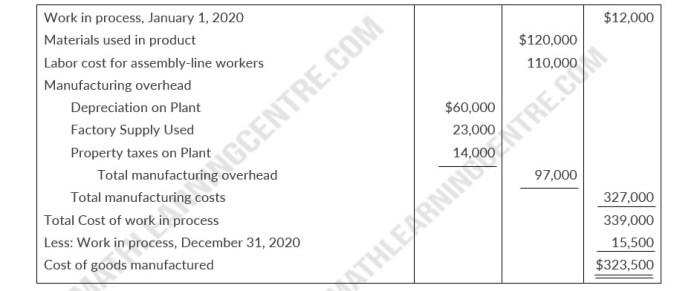

- Manufacturing overhead: Costs incurred in the production process but not directly attributable to a specific product, such as rent, utilities, and depreciation.

- Selling and administrative expenses: Costs related to marketing, sales, and administration, such as advertising, salaries, and office supplies.

Cost Analysis

Analyzing the nature and characteristics of each cost incurred by Lopez Corporation helps in understanding their impact on financial performance:

Fixed Costs

- Remain constant regardless of production or sales volume.

- Examples: Rent, insurance, salaries of administrative staff.

Variable Costs

- Vary directly with production or sales volume.

- Examples: Raw materials, direct labor, utilities.

Semi-Variable Costs

- Partially fixed and partially variable.

- Examples: Utilities, maintenance costs.

Cost Allocation

Lopez Corporation uses the following methods to allocate costs to different departments or business units:

Activity-Based Costing (ABC)

- Allocates costs based on specific activities performed within the organization.

- Provides more accurate cost information than traditional methods.

Direct Cost Allocation

- Assigns costs directly to the department or unit that incurs them.

- Simple and easy to implement.

Indirect Cost Allocation

- Uses a predetermined allocation rate to assign indirect costs to departments or units.

- Can be complex and time-consuming.

Cost Control Measures, Lopez corporation incurred the following costs

Lopez Corporation implements the following cost control measures:

Budgeting

- Establishes spending limits for each department or unit.

- Helps identify and control unnecessary expenses.

Standard Costing

- Compares actual costs to predetermined standard costs.

- Highlights areas of cost inefficiencies.

Variance Analysis

- Investigates the reasons for differences between actual and standard costs.

- Provides insights for cost optimization.

Financial Reporting

Incurred costs are reflected in Lopez Corporation’s financial statements as follows:

Income Statement

- Direct costs are reported as expenses.

- Indirect costs are allocated to the period in which they are incurred.

Balance Sheet

- Inventories include direct costs of materials and labor.

- Prepaid expenses include indirect costs that have not yet been incurred.

General Inquiries: Lopez Corporation Incurred The Following Costs

What are the different cost categories incurred by Lopez Corporation?

Lopez Corporation incurs various cost categories, including direct costs, indirect costs, fixed costs, variable costs, and operating costs.

How does Lopez Corporation allocate costs to different departments?

Lopez Corporation utilizes various cost allocation methods, such as direct allocation, activity-based costing, and departmental overhead rates, to allocate costs to different departments.

What are the key cost control measures implemented by Lopez Corporation?

Lopez Corporation has implemented cost control measures such as budget monitoring, variance analysis, cost reduction initiatives, and employee training to manage costs effectively.