State and local tax revenue sources do not include a diverse array of mechanisms employed by governments to generate income for funding public services and infrastructure. This exploration delves into the intricacies of these revenue streams, examining their nature, assessment methods, and impact on the economy.

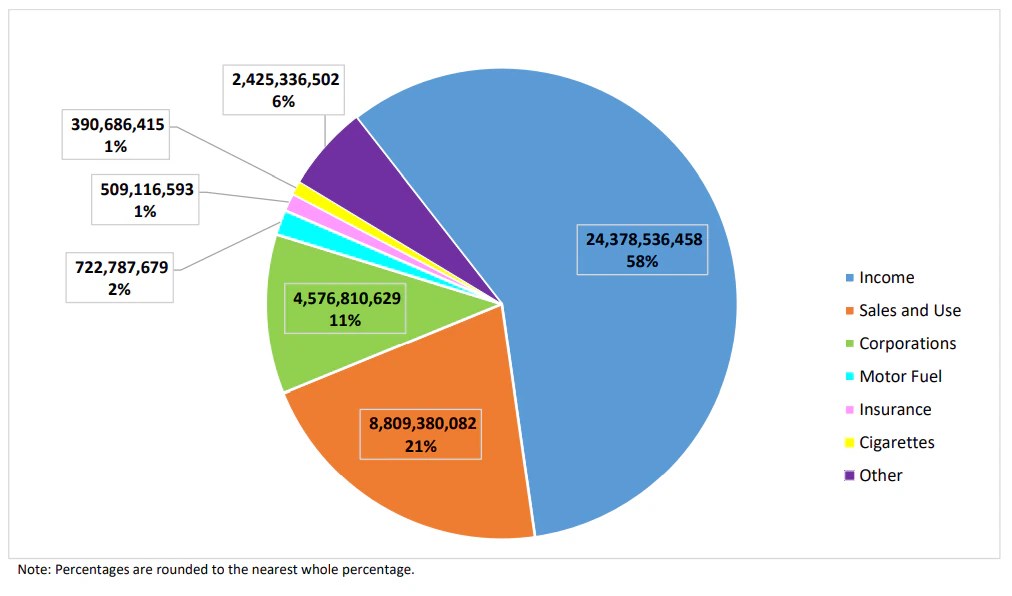

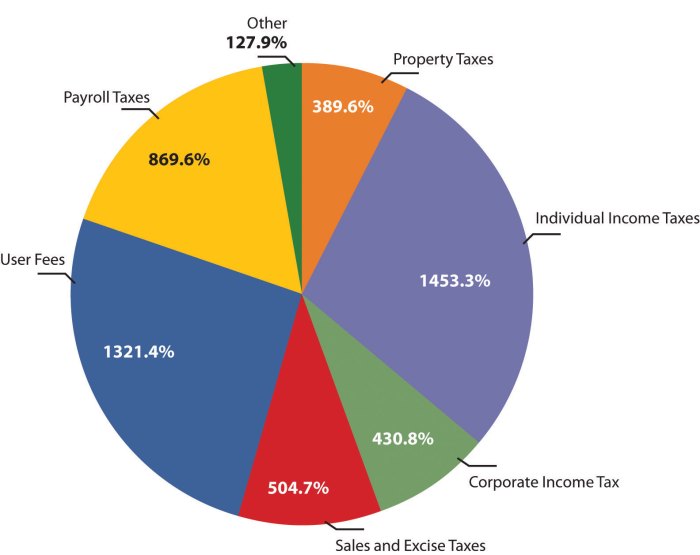

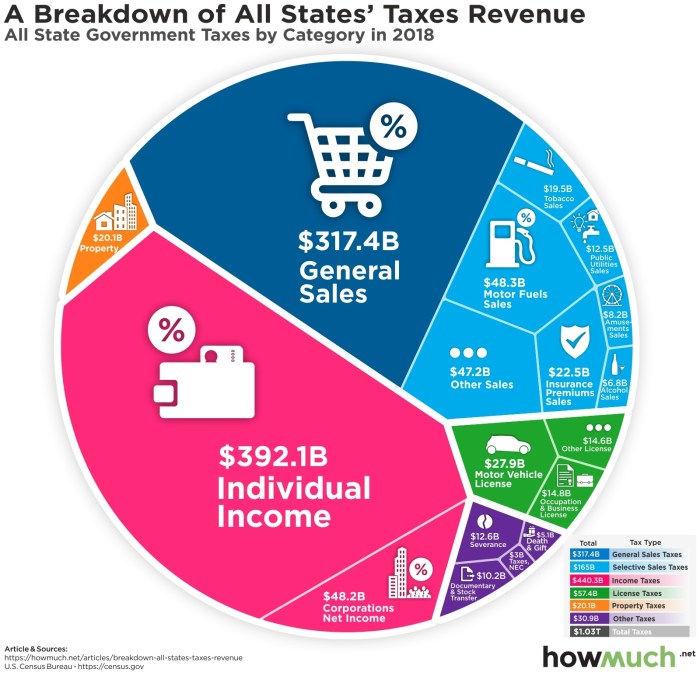

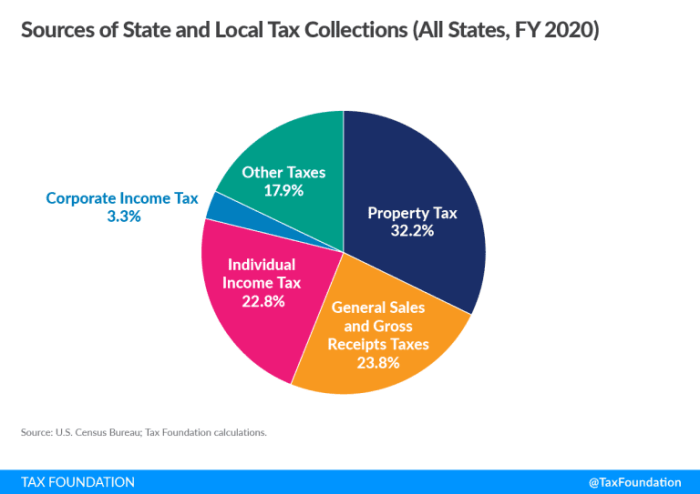

Property taxes, sales taxes, and income taxes constitute the cornerstone of state and local tax revenue. Property taxes are levied on real estate and are typically assessed based on the property’s value. Sales taxes are imposed on the purchase of goods and services, while income taxes are calculated on individuals’ and businesses’ earnings.

1. Property Taxes

Property taxes are a type of ad valorem tax, which means that they are based on the value of the property being taxed. Property taxes are typically assessed by local governments and are used to fund a variety of public services, such as schools, roads, and libraries.

Property taxes are assessed by a local tax assessor, who determines the value of the property. The tax rate is then applied to the assessed value to determine the amount of property tax owed. Property taxes are typically paid in installments over the course of the year.

Types of Property Subject to Property Taxes

- Residential property

- Commercial property

- Industrial property

- Agricultural property

2. Sales Taxes

Sales taxes are a type of consumption tax that is levied on the sale of goods and services. Sales taxes are typically imposed by state and local governments and are used to fund a variety of public services, such as schools, roads, and healthcare.

Sales taxes are typically a flat percentage of the purchase price of the goods or services being purchased. However, some states and localities have a graduated sales tax system, which means that the tax rate increases as the purchase price increases.

Types of Sales Taxes

- General sales tax

- Selective sales tax

- Use tax

3. Income Taxes

Income taxes are a type of tax that is levied on the income of individuals and businesses. Income taxes are typically imposed by federal, state, and local governments and are used to fund a variety of public services, such as Social Security, Medicare, and education.

Income taxes are calculated by applying a tax rate to the taxable income of the individual or business. Taxable income is the amount of income that is subject to taxation after deductions and exemptions have been applied.

Types of Income Subject to Income Taxes, State and local tax revenue sources do not include

- Wages and salaries

- Self-employment income

- Investment income

- Capital gains

4. Other State and Local Tax Revenue Sources

In addition to property taxes, sales taxes, and income taxes, state and local governments also have a number of other revenue sources, including:

- Excise taxes

- License fees

- Fines and forfeitures

- Lottery revenue

These revenue sources are typically used to fund a variety of public services, such as parks, recreation, and public safety.

5. Impact of State and Local Tax Revenue Sources on the Economy

State and local tax revenue sources have a significant impact on the economy. Tax revenue can be used to fund public services, which can improve the quality of life for residents and make a region more attractive to businesses.

Tax revenue can also be used to fund infrastructure projects, such as roads, bridges, and schools. These projects can improve the efficiency of the economy and make it more competitive.

FAQ Summary: State And Local Tax Revenue Sources Do Not Include

What are the primary sources of state and local tax revenue?

Property taxes, sales taxes, and income taxes are the main sources of state and local tax revenue.

How are property taxes assessed?

Property taxes are typically assessed based on the value of the property, as determined by local assessors.

What is the difference between a sales tax and a use tax?

A sales tax is imposed on the purchase of goods and services, while a use tax is levied on the use or storage of goods purchased outside the state.